Estate Planning is important in ensuring that your wishes are met both during your lifetime, and after your death. Your Estate Plan ensures that upon your death, your assets will be managed and transferred in the most financially efficient and tax-effective way to the people you wish to benefit.

An Estate Plan includes:

Your assets may include property, shares, superannuation, insurances or valuables.

In short, an Estate Plan formalises your wishes in writing, and ensures there is no uncertainty on how you would like your assets handled.

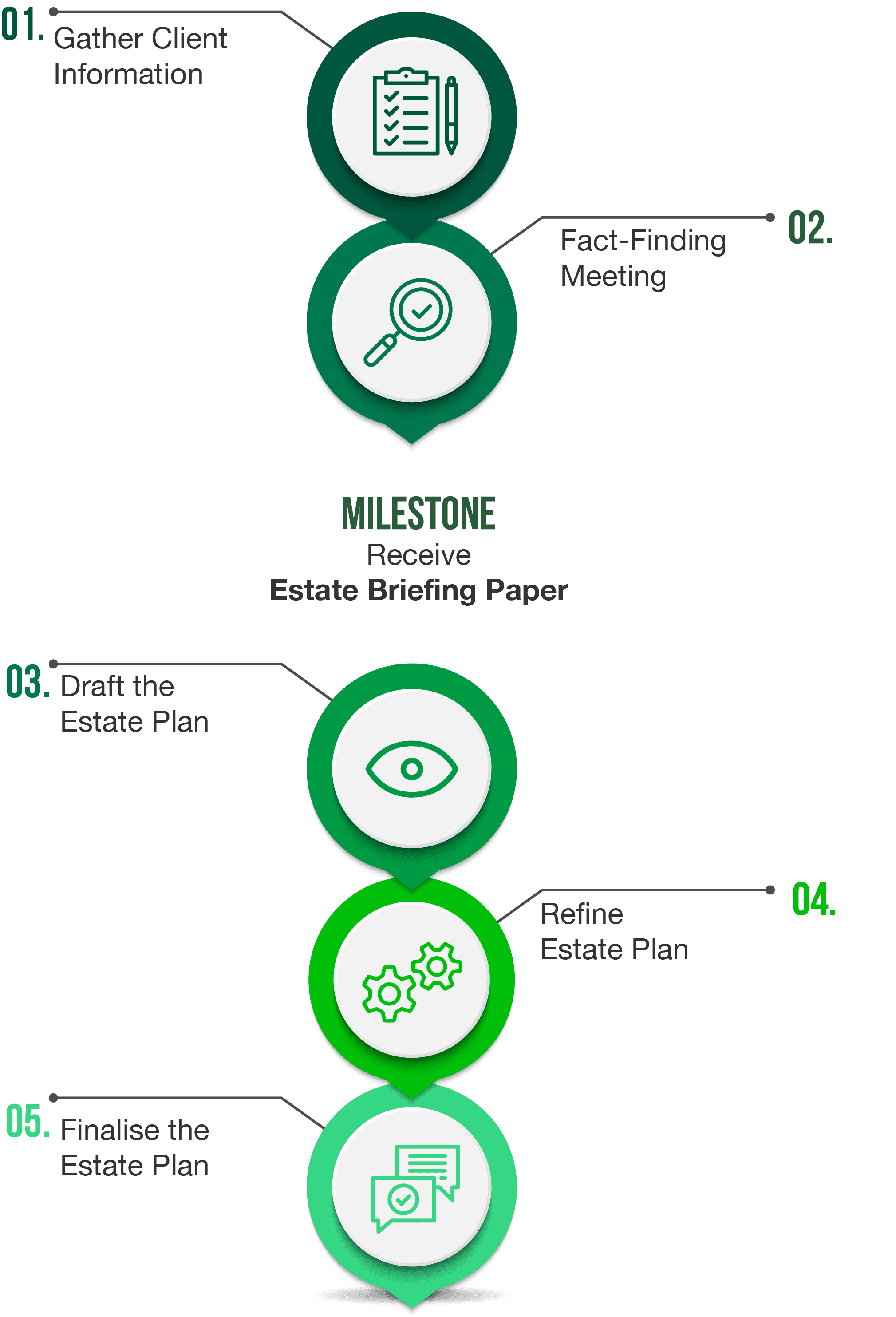

As accountants & financial advisors we are best placed to truly understand your personal and business structure to discuss with you your wishes, identify tax efficient strategies for your estate planning, and ensure this is all correctly articulated to a lawyer so that your Will truly reflects your intentions.

Managing your personal expenses in the face of the rising cost of living. We run through a live demo of our detailed 12-month personal budget worksheet so you know how you can effectively use this tool yourself.

ONLINE WEBINAR

28 September 2023 // 12:30 - 1:30p.m.

In today's ever-changing economic landscape, facing redundancy can be daunting, impacting both your financial and emotional well-being. This

webinar is tailored to address these concerns, offering practical insights and strategies to navigate the complexities of redundancy and

secure your financial future.

ONLINE WEBINAR

27 July 2023 // 12:30-1:30pm

(ESG) considerations have become increasingly important for investors as they look to make investment decisions that align with their values

and have a positive impact on the world.

ONLINE WEBINAR

21 June 2023 // 12:30-1:30pm

Many people believe that if they have a valid Will they also have

an estate plan, but this is not so. While a Will outlines where the deceased individual's assets will be distributed, it does not

include various other documents and directives that are available.

ONLINE WEBINAR

27 April 2023 // 12:30pm

Let's face it, insurance is not the most exciting topic. In

this webinar we'll offer guidance on how to compare different insurance policies, assess your risk, read beyond the marketing and how

to get the most value for your money.

ONLINE WEBINAR

30 March 2023 // 12:30pm

Gen Z, it’s time to level up your financial literacy. This is the stuff that you didn’t learn in school. Get ready to learn the ins and outs

of budgeting, saving, and investing in a way that’s relevant to where you’re at right now.

With over $13 BILLION dollars in unclaimed super across Australia, it’s evident that many are not even really sure on how super works. Our expert financial advisors want to give you back control over your money.