key person - capital insurance

Welcome to Smart Private Wealth • Services • Business Insurance

Welcome to Smart Private Wealth • Services • Business Insurance

A key person is an individual whose continued association with a business provides that business with a significant and direct economic

gain. This may be the CEO, Founding Director, Director or similar senior position.

Economic gain means more than just profits. It can also include capital injections, cost efficiency, goodwill, access to credit and contacts with suppliers and customers. Business owners will also usually be key people.

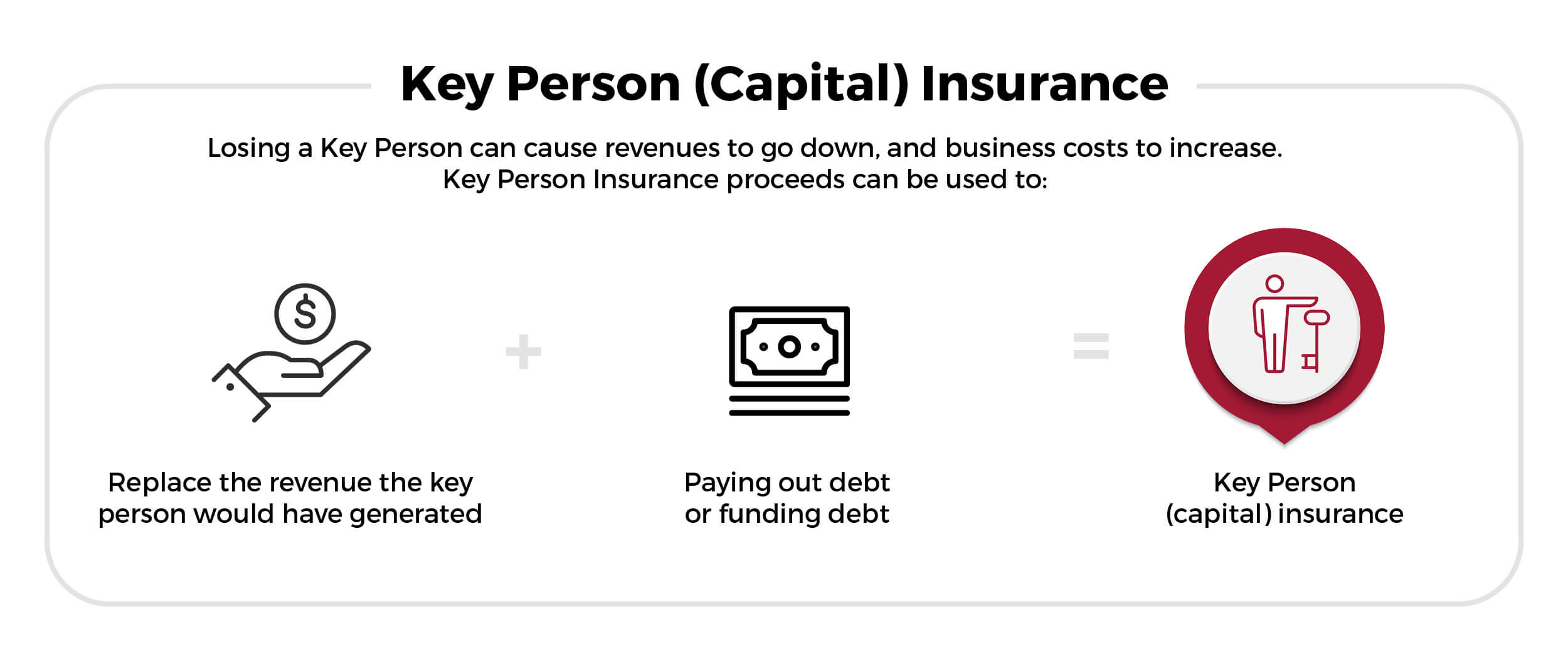

Key person insurance can compensate the business for the loss of a key person in two different ways: business profitability (revenue purpose) and the capital value of the business (capital purpose). Key person insurance proceeds can be applied to maintain the capital value and stabilise the business.

|

|

Repaying the estate of a deceased key person for loans made by the deceased key person to the business. |

|

|

Repaying other debts called in because of the loss of the key person. |

|

|

Replacing the value of goods will be lost because the key person is no longer there. |

|

|

Replacing lines of credit guaranteed by the key person. |

A testamentary trust is commonly used by estate planning lawyers to protect the assets and inheritance of the testator’s benefciaries from creditors, family law actions and providing flexibility in relation to the distribution of the estate.

There are limits on how much you can pay into your super fund each financial year without having to pay extra tax. These limits are called ‘contribution caps’.