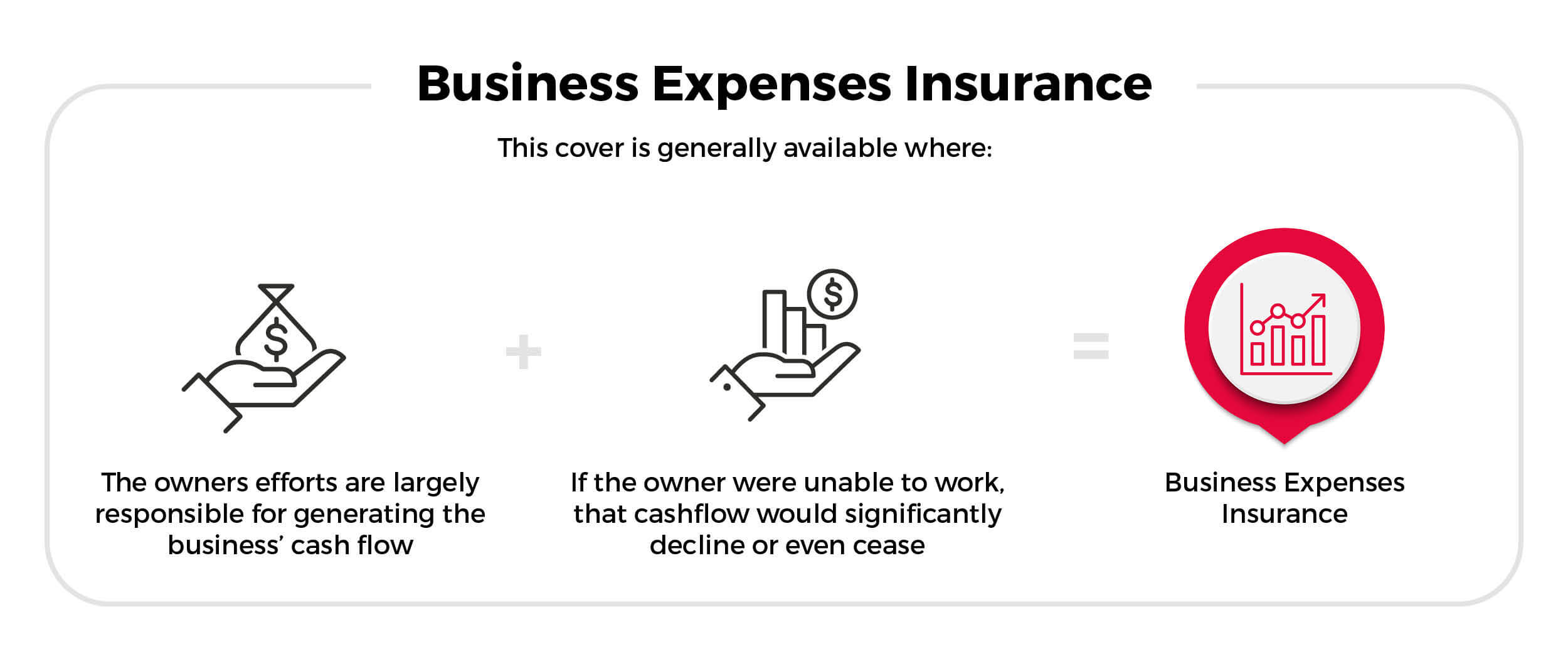

Business Expenses Insurance

Welcome to Smart Private Wealth • Services • Business Insurance

Welcome to Smart Private Wealth • Services • Business Insurance

If you are self-employed or in a small partnership, your extended absence from the business through sickness or injury can have a major

impact on the business’ ongoing viability, and the financial security of your family.

Business Expenses Insurance may help protect you by paying a monthly benefit you or your business to help cover the fixed business

expenses that continue to be incurred while you are unable to work due to illness or injury.

For

For comprehensive cover details and for information on our insurance underwriter, please get in touch with the Smart Private Wealth team.

For

For comprehensive cover details and for information on our insurance underwriter, please get in touch with the Smart Private Wealth team.|

|

Rent |

|

|

Loan interest repayments (not principal) |

|

|

Business expenses required in maintaining the property, including utilities, telephone, cleaning, property rates & taxes |

|

|

General insurance premiums only (not life insurance premiums) |

|

|

Salaries of costs for non-income producing staff |

|

|

General expenses including fees for accountants, auditors, general insurance premiums, advertising costs, leasing costs on equipment or vehicles and subscriptions to professional associations |

|

|

Any other fixed expenses of non-business income generating activities may be included. |

A testamentary trust is commonly used by estate planning lawyers to protect the assets and inheritance of the testator’s benefciaries from creditors, family law actions and providing flexibility in relation to the distribution of the estate.

There are limits on how much you can pay into your super fund each financial year without having to pay extra tax. These limits are called ‘contribution caps’.