Three things you should consider before investing in multigenerational living.

Granny flats and multi-generational housing have garnered a lot of media attention lately as possible remedies for rising housing costs. Yet there are three important things you should know before you dive in.

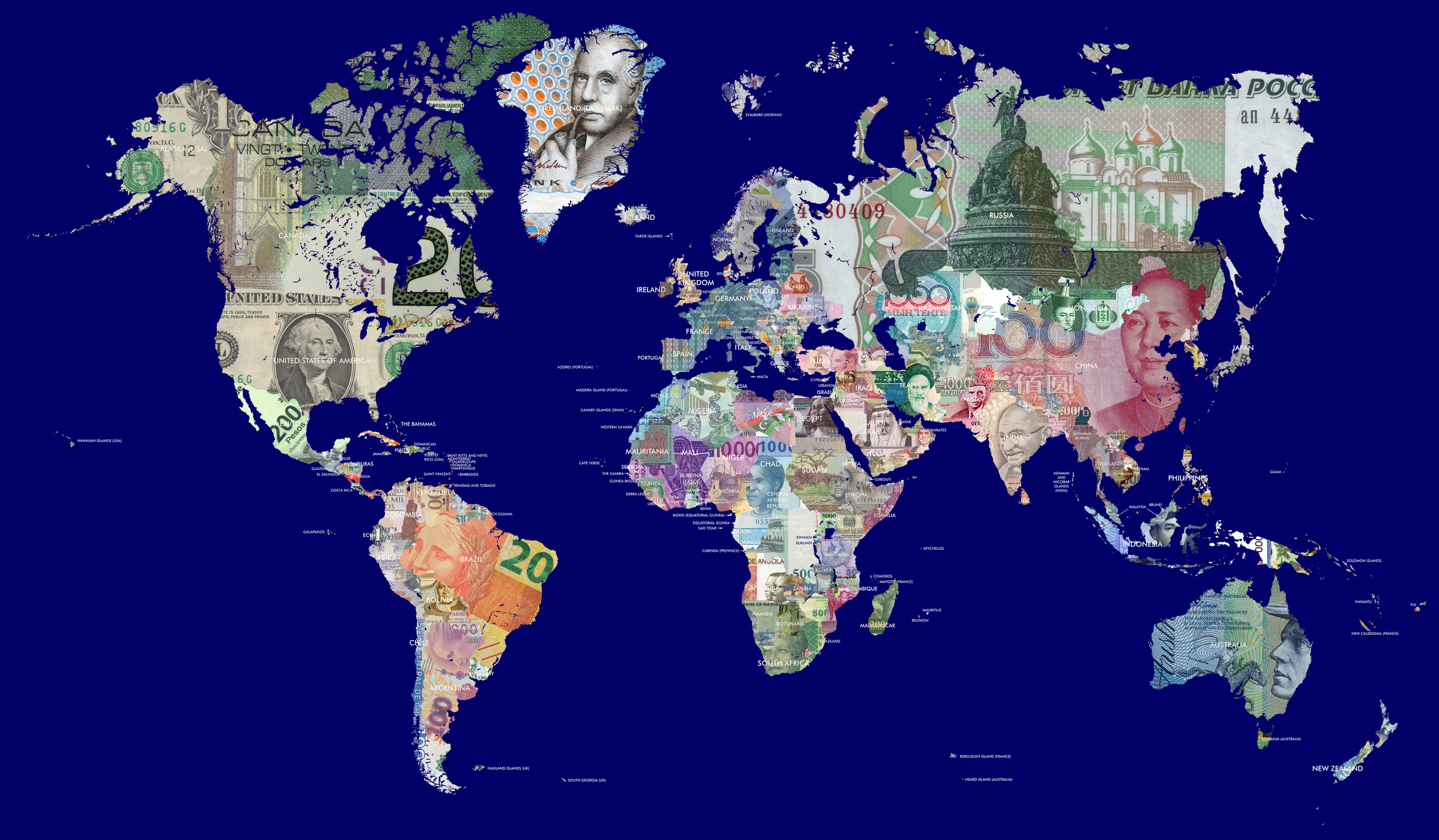

What do rising geopolitical tensions mean for investment markets?

As conflicts between nations flare into open armed warfare and elections around the world become more contentious, there’s plenty to spike investor concern. We look at how wars and political tensions influence investment markets over the long term and examine the im- plications for your retirement savings.

Maximising Returns: A guide to property investment

Investing in property can be a lucrative venture, especially for small business owners looking to diversify their portfolio or secure a stable source of income. However, navigating the complexities of property investment and taxation requires careful planning and understanding of the rules. In this guide, we’ll explore key strategies and considerations for small business owners or investors interested in property investment, helping you maximize returns and minimise risks.

We can help you budget, build wealth and make sure your income is covered adequately to avoid stress and live a life you love.

The global economy is being shaped by conflicting triggers. These include productivity-boosting technology innovations, geopolitical tensions and the strident efforts of central banks to bring inflation under control. We examine the economic outlook and discuss the implications for your retirement savings.

With inflation coming off the boil, there was optimism that borrowing costs have peaked and could be lowered later this year. In turn, this could be beneficial for corporate earnings.