Three things you should consider before investing in multigenerational living.

Granny flats and multi-generational housing have garnered a lot of media attention lately as possible remedies for rising housing costs. Yet there are three important things you should know before you dive in.

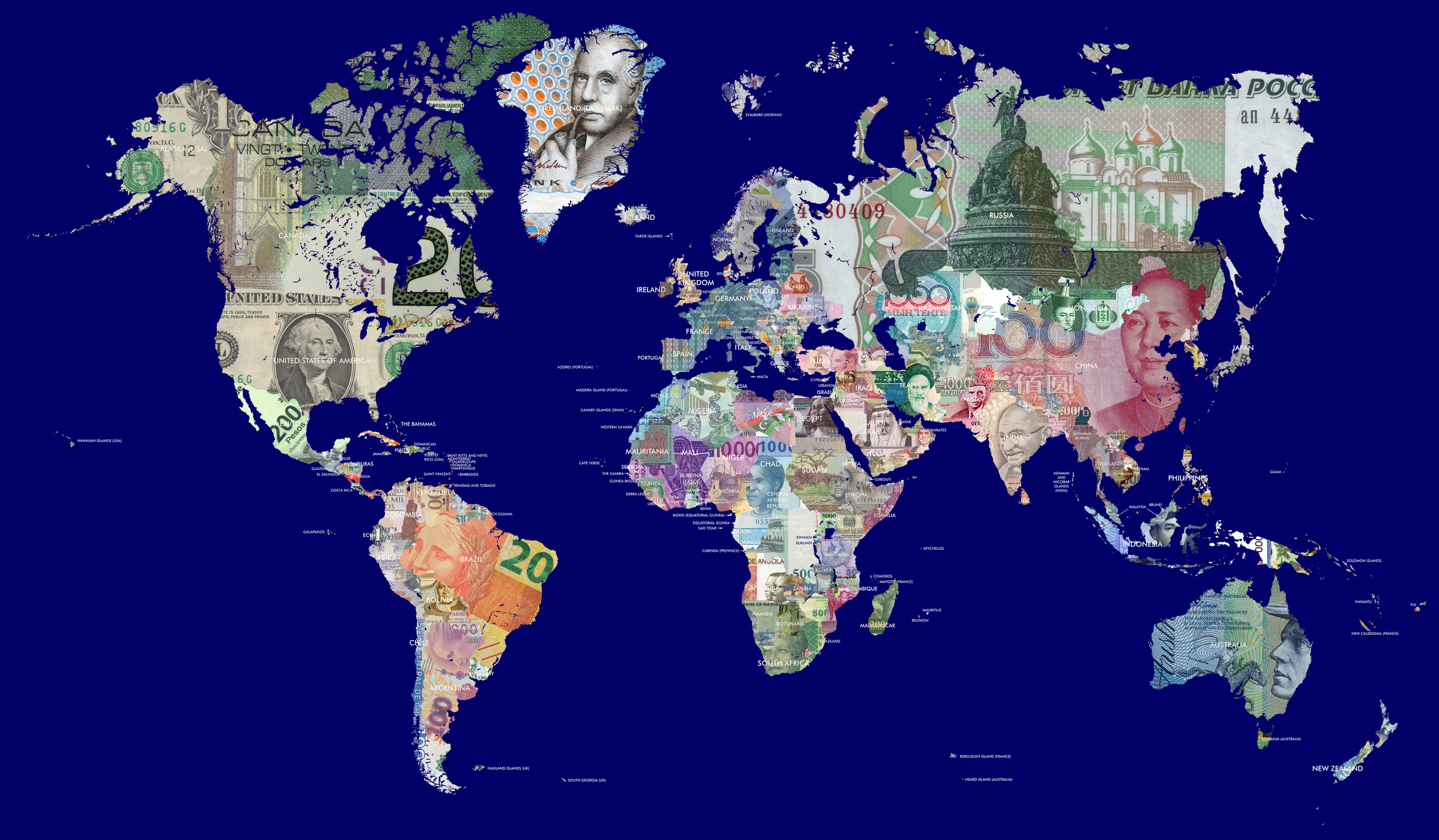

What do rising geopolitical tensions mean for investment markets?

As conflicts between nations flare into open armed warfare and elections around the world become more contentious, there’s plenty to spike investor concern. We look at how wars and political tensions influence investment markets over the long term and examine the im- plications for your retirement savings.

Maximising Returns: A guide to property investment

Investing in property can be a lucrative venture, especially for small business owners looking to diversify their portfolio or secure a stable source of income. However, navigating the complexities of property investment and taxation requires careful planning and understanding of the rules. In this guide, we’ll explore key strategies and considerations for small business owners or investors interested in property investment, helping you maximize returns and minimise risks.

We can help you budget, build wealth and make sure your income is covered adequately to avoid stress and live a life you love.

Understanding the 3 stages of retirement and what they mean for your money, and how to future proof your retirement income.

SMART Business Solutions is proud to announce its recognition as the winner of Excellence in Local Community Connection (Medium–Large Business) and Excellence in Access and Inclusion at the 2025 Mornington Peninsula Business Excellence Awards.

Smart Private Wealth is proud to announce that Founding Director, Shannon Smit, has been recognised in the 2025 FS Power50, Financial Standard’s annual list of the 50 most influential financial advisers in Australia.