Super returns hit in wild market ride

Welcome to Smart Private Wealth • Learning Centre • Insights

Welcome to Smart Private Wealth • Learning Centre • Insights

The traditional diversification strategies of super funds are failing, and a worsening inflation picture keeps the pressure on global

central banks to push harder through with aggressive interest rate increases.

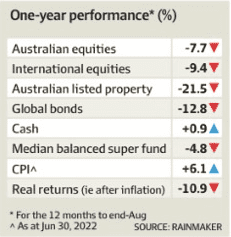

The average balanced super fund return dipped to just under 5 per cent over the past 12 months, with the worst performers dropping 11 per

cent, according to analysis by research group Rainmaker.

This compares to 2020-2021 record returns of around 15 per cent.

Only one of a total of 102 balanced super funds earned a positive return. Australian shares rallied 1.8 per cent on Friday after erratic rides on Wall Street, where the US economy is experiencing hotter-than-expected inflation and experiencing a roller-coaster.

The rally also served to highlight expectations of further share market volatility. The flip side of increasing inflation, the energy crisis

and climbing interest rates has fuelled predictions of a recession for the United States.

But brokers at UBS warned that while the Australian economy could withstand an interest rate hike, the same would not be true for Australia's market. Brokers say 7000 points is achievable for the market by the end of 2022.

The benchmark closed at 6758.8. The Australian dollar surged to 21⁄2-year high at 63.28 cents to the US dollar, one of the highest

exchange rates in recent years. After slipping to a 21⁄2-year low of 61.70¢.

Federal Reserve Chairman Jerome Powell continues edging slightly closer to his next potential hike in interest rates, likely in November,

and traders don't expect the situation to improve if there isn't a rate hike soon.

US CPI consumer prices unexpectedly inched up for the second month in a row with headline CPI increasing by 8.2% year-on-year; and core

inflation jumping by 6.6% year-on-year.

There is a real loss of 10.9% for balanced super funds, which account for inflation. That loss is adjusted for June's official inflation

rate of 6.1%. The economy's rate of inflation was 7% in July.

The investment performance of bonds, which include items such as corporate, municipal, and government bonds (traditionally less volatile

than stocks or shares) was worse, averaging a negative return of roughly 9 percent during the 12 months, according to Rainmaker.

“This is pretty scary time,” says Alex Dunnin, executive director of research and compliance at Rainmaker.

“After a decade of record returns, an unprecedented bear market has turned everything on its head. Stocks are down, bonds are down, and cash piles are small. There seems to be nowhere to turn because the normal refuges are not working. It is back with a vengeance.”

A combination of rising inflation and central banks tightening interest rates, which have raised bond yields, pushing prices down and

resulting in negative returns from tax-friendly and risk assets, according to new research. The price market has been continuously pricing

in lower yields, and the market implied peak for the Fed funds rate is now 4.92 per cent in 2023.

The US 2-year yield was up 15.6 basis points to 4.5 percent, while the 10-year yield was up 2.5 basis points to 3.9 percent. The flattening

of the US yield curve "should cause the subcommittee to think a little bit about what their assumptions are for 10-year yields.

AustralianSuper, has roughly $261 billion under management. It expects markets to remain uncertain, with returns for its members being more

subdued than in prior years.

This week, the IMF downgraded its projections for global economic growth in 2023 by 0.2 percentage points to 2.7 per cent, but the

likelihood of a 2 per cent worldwide recession had increased to 25 per cent. The International Monetary Fund has slashed its economic growth

forecast for Australia to 1.9% next year, slightly lower than the Reserve Bank’s 1.8% but well above the last year’s government-expected

2.2%.

"The long-time run-up in asset values is beginning to have a detrimental effect on many retirees’ ability to sustain their standard of living," Minney said.

“Inflation is something investors seriously need to consider for the first time in decades.”

“That means a different approach to investment, particularly in retirement where the majority of money an investor uses is reliant on investments to generate income.”

Domestic monetary inflation running at the highest rate since the mid 90's, and expected to continue into the foreseeable future, will have

the purchasing power of a nest egg in 10 years if it is not managed to compensate for inflation, Mr Minney added.

More than 70 per cent of retired couples received some form of age pension which adjust in real terms over the preceding 20 years of growth.

“Even though retirees spend less on discretionary items, they still must manage their expenses to deal

with currency fluctuations to ensure the lifestyle they desire.” Mr. Minney said.

T Rowe Price portfolio specialist Sam Ruiz said with the market perhaps underestimating how far the Federal Reserve will go to raise rates, stocks may rise as higher inflation provides more fuel for that scenario. “We calibrate and get to the other side,” he said.

We're always up for a financial planning chat. Get in touch to see how we can help shape your retirement.

Important information: This

document contains general advice. It does not take account of your objectives, financial situation or needs. You should consider talking

to a financial adviser before making a financial decision.

While the month began with constructive discussions and agreements between the US and some of its trading partners, uncertainty returned to the market after President Trump threatened to impose new tariffs on Europe and multiple large corporates such as Apple, Samsung and Mattel, and again near month-end as the Court of International Trade deemed the global tariffs to be “contrary to law.”

It’s a powerful question, and one we help clients explore every day. it’s about understanding your whole financial picture and the lifestyle you want to create.