Living Longer: How to future-proof your retirement income

Welcome to Smart Private Wealth • Learning Centre • Insights

Welcome to Smart Private Wealth • Learning Centre • Insights

With more Australians living well into their 80s and beyond, managing your longevity risk is more important than ever. Learn how income products like annuities can support your lifestyle for the long haul – no matter how long your retirement lasts.

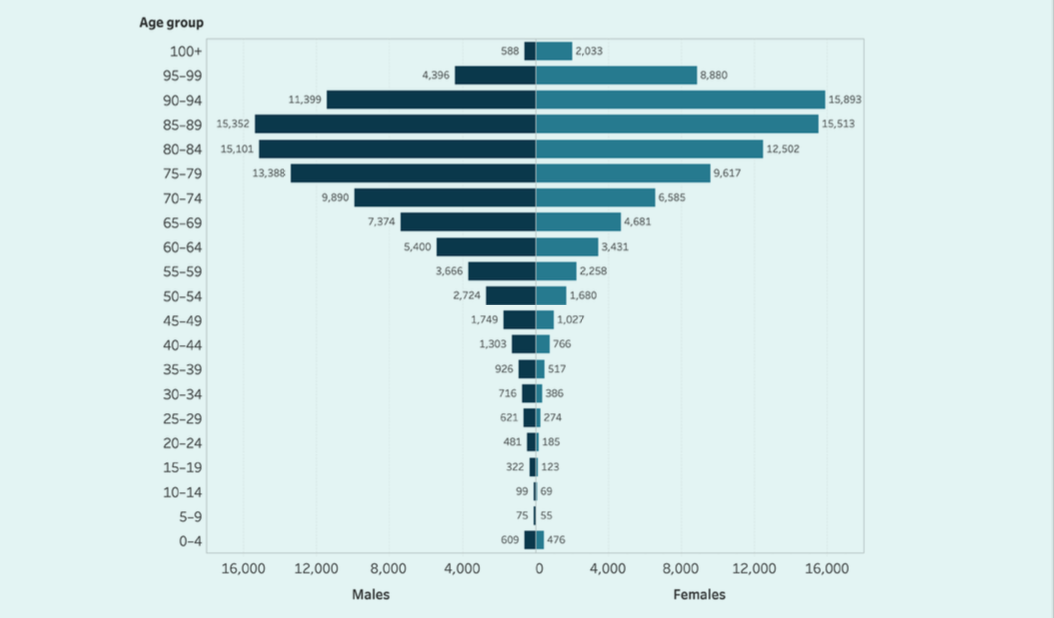

In many ways, living longer is a nice problem to have. Life expectancy in Australia now exceeds 81 years for men and 85 years for women. Yet, behind these averages, there are huge differences in how long people actually live. In 2023, the median age at death was 79.6 years for males and 84.6 years for females. Yet half of the people who died that year were older, with many much older (see Figure 1). So, if you were working towards your money lasting to age 79.6 as a man or age 84.6 as woman, then you’d have a 50% chance of outliving your money.

That’s why a ‘one size fits all’ approach to retirement planning doesn’t work. As medical innovations continue to extend our years, factoring in the age that your parents died may not be a good indicator of your own life expectancy.

One of the biggest fears many retirees have is that they will outlive their money. This fear results in many retirees drawing down no more than the compulsory minimum from their account-based allocated pension. The risk here is that retirees may later regret being so frugal and they may pass away with a relatively large fund balance – savings that could have made their retirement much more enjoyable and comfortable.

FIGURE 1

Talk to us to help to balance your spending today while also protecting against your longevity risk, talk to us.